AAre You Ready To

Unchain

Your Dollars?

Join us for a free educational workshop introducing time-tested financial principles often overlooked in traditional financial education. You’ll explore approaches that may help you manage debt more efficiently while building greater financial flexibility over time.

If you’ve ever wanted to understand how many financially successful families balance debt reduction with long-term savings goals, this workshop will share examples and frameworks you can learn from.

Register Now To Reserve Your Spot!

Next Webinar: Tuesday October 28th @ 7pm EST

This webinar is for educational purposes only and is not intended for individual financial or tax advice.

First Things First

A Better Strategy For Better Results

We believe a strong financial plan begins with a simple idea: debt and wealth serve different purposes. With the right mindset, you can explore strategies that may help your dollars work more efficiently — supporting future growth while you manage existing debt. In this workshop, you’ll learn approaches that show how these goals can align within a single plan.

That’s the concept behind The Unchained Dollar.

So How Does It Work?

Start Your Journey to Financial Independence Here

Register For The Webinar

Join our next LIVE Unchained Dollar Webinar and discover how some of the most financially efficient families:

• Explore strategies designed to help manage and reduce debt more efficiently — even long-term obligations such as mortgages.

•Learn how to structure savings for greater flexibility and liquidity over time.

In just 45 minutes, you'll learn about potentially smarter ways to manage your dollars and position yourself for long-term success.

Learn The Strategy

During the live educational workshop, you'll learn how to:

• Unchain your dollars and potentially make them work harder for you – possibly even in two places at once.

• Implement strategies designed to help you build savings that remain liquid, tax-efficient, and protected from potential creditors, and/or, market based losses.

• Discover how thoughtful planning can help align your debt strategy with the life you want to live.

• Leverage some of the same strategies used by the most financially successful, affluent individuals & institutions.

• Gain the knowledge and confidence to take control of your finances and build more resilient financial foundations.

Put Your Dollars To Work

After the webinar, you'll have the opportunity to receive a personal analysis and plan

that will show:

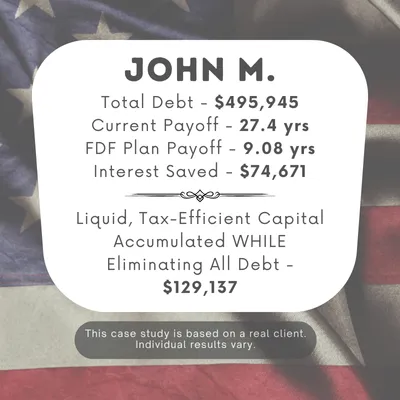

• An illustrative example of how a debt-reduction timeline might look based on your circumstances.

• How much in liquid, tax-efficient savings you could potentially build along the way.

• The personal analysis & plans are provided at no cost to those who attend the live webinar.

Are You Ready To

Unchain

Your Dollars?

Join us for a free educational workshop introducing time-tested financial principles often overlooked in traditional financial education. You’ll explore approaches that may help you manage debt more efficiently while building greater financial flexibility over time.

If you’ve ever wanted to understand how many financially successful families balance debt reduction with long-term savings goals, this workshop will share examples and frameworks you can learn from.

Register Now To Reserve Your Spot!

Next Webinar: Tuesday October 28th @ 7pm EST

This webinar is for educational purposes only and is not intended for individual financial or tax advice.

First Things First

A Better Strategy For Better Results

We believe a strong financial plan begins with a simple idea: debt and wealth serve different purposes. With the right mindset, you can explore strategies that may help your dollars work more efficiently — supporting future growth while you manage existing debt. In this workshop, you’ll learn approaches that show how these goals can align within a single plan.

That’s the concept behind The Unchained Dollar.

So How Does It Work?

Start Your Journey To Financial Independence Today

Register For The Webinar

Join our next LIVE Unchained Dollar Webinar and discover how some of the most financially efficient families:

• Explore strategies designed to help manage and reduce debt more efficiently — even long-term obligations such as mortgages.

•Learn how to structure savings for greater flexibility and liquidity over time.

In just 45 minutes, you'll learn about potentially smarter ways to manage your dollars and position yourself for long-term success.

Learn The Strategy

During the live educational workshop, you'll learn how to:

• Unchain your dollars and potentially make them work harder for you – possibly even in two places at once.

• Implement strategies designed to help you build savings that remain liquid, tax-efficient, and protected from potential creditors, and/or, market based losses.

• Discover how thoughtful planning can help align your debt strategy with the life you want to live.

• Leverage some of the same strategies used by the most financially successful, affluent individuals & institutions.

• Gain the knowledge and confidence to take control of your finances and build more resilient financial foundations.

Put Your Dollars To Work

After the webinar, you'll have the opportunity to receive a personal analysis and plan

that will show:

• An illustrative example of how a debt-reduction timeline might look based on your circumstances.

• How much in liquid, tax-efficient savings you could potentially build along the way.

• The personal analysis & plans are provided at no cost to those who attend the live webinar.

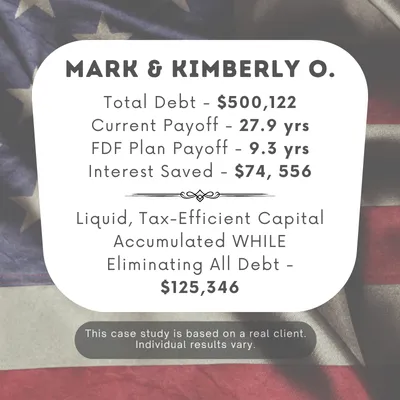

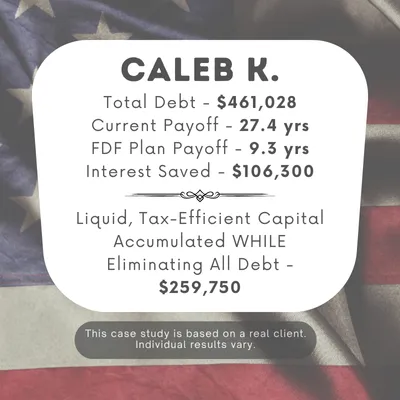

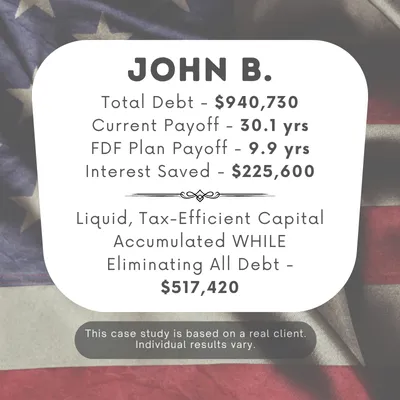

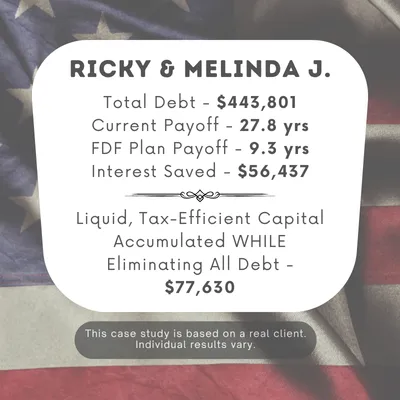

See What Could Happen When You Unchain Your Dollars

See What Could Happen When You Unchain Your Dollars

Meet The Presenter

Jeff Brummett

Jeff is an Amazon #1 best-selling author, public speaker, popular radio talk show host and a 30-year executive management leader, and Founder/President of a

prestigious two-time Inc. 500 Company. Jeff is also a highly sought after public speaker/educator in the fields of debt elimination, retirement planning, and wealth

management.

Meet The Presenter

Jeff Brummett

Jeff is an Amazon #1 best-selling author, public speaker, popular radio talk show

host and a 30-year executive management leader, and Founder/President of a

prestigious two-time Inc. 500 Company. Jeff is also a highly sought after public

speaker/educator in the fields of debt elimination, retirement planning, and wealth

management.

Frequently Asked Questions

What will I learn in the webinar?

You'll discover how to use your dollars more efficiently - so they can help reduce debt faster while building liquid, tax-efficient savings at the same time. The webinar explains the same strategies many big financial institutions use, but in a way everyday families and business owners can apply.

How long is the webinar?

The session lasts about 45 - 60 minutes, and includes time for Q&A. It's designed to be engaging, fast-paced, and packed with education you can use right away.

Does it cost anything to attend?

No - the webinar is completely free to attend. All you need to do is get registered to reserve your spot.

Do I have to share my financial information?

Not during the webinar. The session is purely educational. You'll learn the concepts and see examples without needing to provide personal details. If you want a personalized plan afterward, you'll have the option to schedule a private consultation.

Who is this webinar for?

Anyone who wants to discover strategies that could accelerate debt payoff and potentially build higher long-term tax-efficient savings.

What if I can't attend live?

We recommend attending live so you can interreact and ask questions with the presenter, but if you register and can't make it, we'll send you details on future sessions.

Frequently Asked Questions

What will I learn in the webinar?

You'll discover how to use your dollars more efficiently - so they can help reduce debt faster while building liquid, tax-efficient savings at the same time. The webinar explains the same strategies many big financial institutions use, but in a way everyday families and business owners can apply.

How long is the webinar?

The session lasts about 45 - 60 minutes, and includes time for Q&A. It's designed to be engaging, fast-paced, and packed with education you can use right away.

Does it cost anything to attend?

No - the webinar is completely free to attend. All you need to do is get registered to reserve your spot.

Do I have to share my financial information?

Not during the webinar. The session is purely educational. You'll learn the concepts and see examples without needing to provide personal details. If you want a personalized plan afterward, you'll have the option to schedule a private consultation.

Who is this webinar for?

Anyone who wants to discover strategies that could accelerate debt payoff and potentially build higher long-term tax-efficient savings.

What if I can't attend live?

We recommend attending live so you can interreact and ask questions with the presenter, but if you register and can't make it, we'll send you details on future sessions.

Educational webinar. Individual results vary. No cost, no obligation.

All content, materials, and concepts presented in The Unchained Dollar webinar and on this website are proprietary and protected under copyright. If you are a financial professional reviewing this information, please respect these intellectual property rights. To explore legitimate partnership or affiliate opportunities, contact us directly.

© 2025 The Unchained Dollar™ | All Rights Reserved

Use of this site and registration for any webinar constitutes your agreement to our Privacy Policy and Terms of Use. We collect basic contact information to confirm registrations, send email & SMS reminders, and share related educational content. We do not sell personal information and only use trusted third-party services to deliver secure communications. You may unsubscribe from future messages at any time by following the instructions in our emails or texts.

© 2025 The Unchained Dollar™ | All Rights Reserved

Educational webinar. Individual results vary. No cost, no obligation.

All content, materials, and concepts presented in The Unchained Dollar webinar and on this website are proprietary and protected under copyright. If you are a financial professional reviewing this information, please respect these intellectual property rights. To explore legitimate partnership or affiliate opportunities, contact us directly.

© 2025 The Unchained Dollar™ | All Rights Reserved

Use of this site and registration for any webinar constitutes your agreement to our Privacy Policy and Terms of Use. We collect basic contact information to confirm registrations, send reminders, and share related educational content. We do not sell personal information and only use trusted third-party services to deliver secure communications. You may unsubscribe from future messages at any time by following the instructions in our emails or texts.